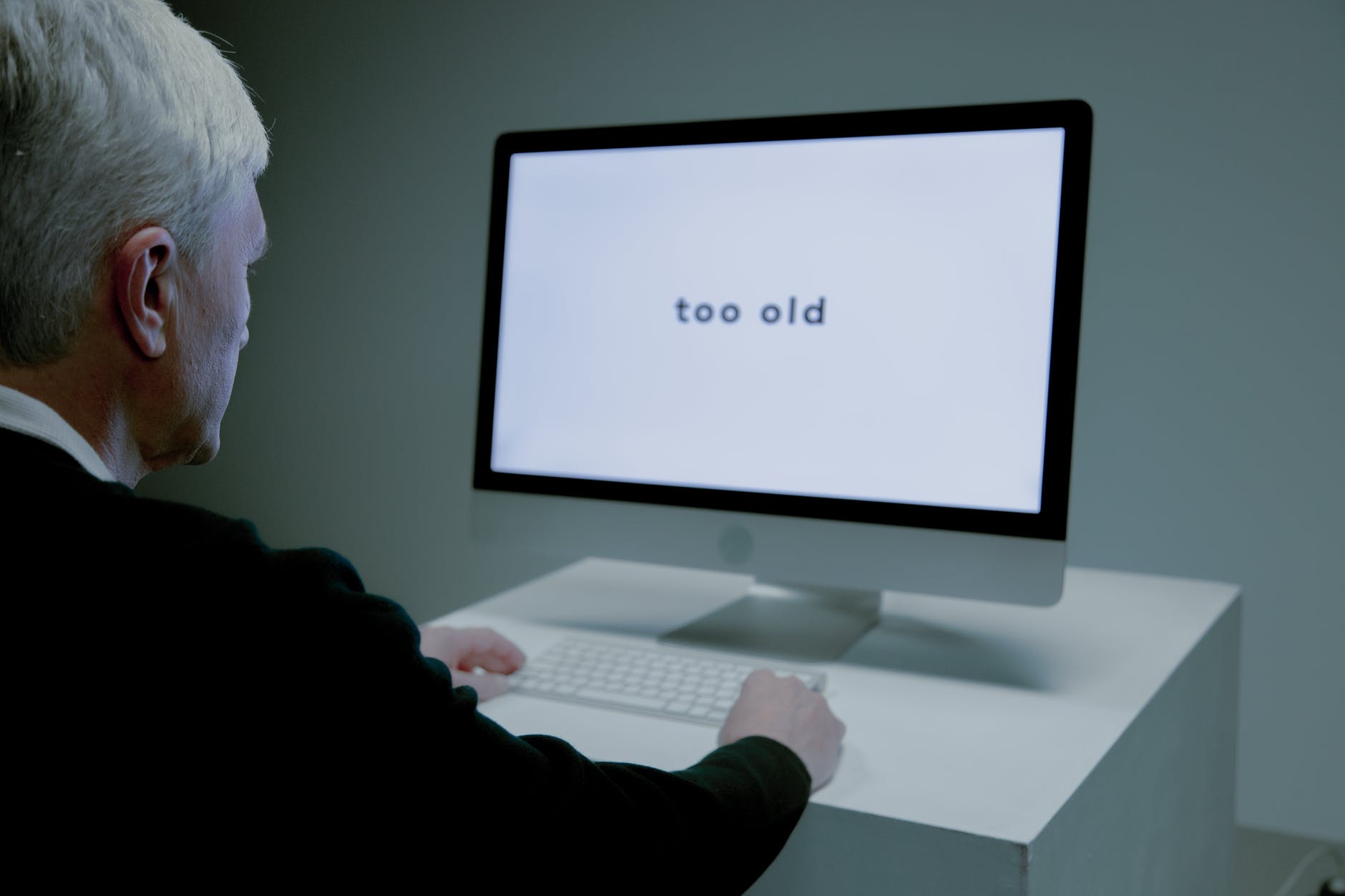

Above two images give you a good overview of National Pension Scheme. If you do not want to read the entire blog, please spend time reading the above two images.

Remember, the purpose of National Pension Scheme is not to save you more taxes – it is to provide for the cashflows after retirement. Saving of taxes makes NPS more attractive. Remember, when we have pensions our Human Capital is extended? NPS allows just that, it increases our Human Capital by providing a nice safety net by making us invest in Annuity products when we decide to retire.

If you have no cash flow issues and are doing enough investments towards your present day goals – please don’t miss out on NPS. It is an awesome instrument which guarantees our financial life post retirement. We will talk more about Annuity products in another blog.

Remember that purpose of Annuity products is to actually extent and increase your human capital. At least 40% of corpus accumulated from NPS is used to buy Annuities. So essentially NPS is a nice financial tool for extending your Human Capital.

Note – if your present employer does not provide for Corporate NPS, talk to them to have this facility arranged. Please click here to know about tax savings from NPS .