EPF Passbook should be checked yearly to ensure that our contributions are reflected Correctly. EPF passbook viewing option was down for a last few weeks and it is up again now. You can now check your EPF passbook.

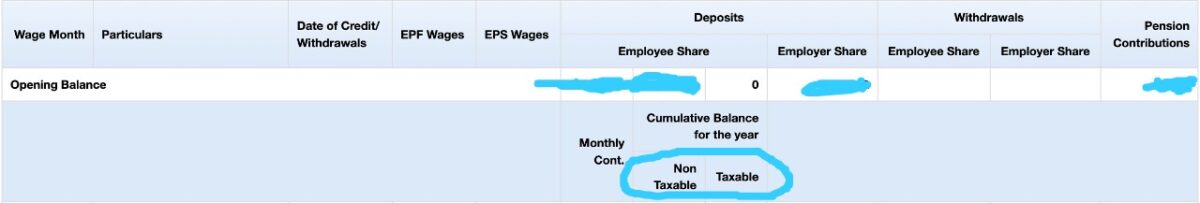

What exactly has changed in the passbook that warrants us to check? The EPFO changed the rules recently to limit tax free contribution by employee upto 2.5L per FY. This detail has been now added into the Passbook now. So its important to check and ensure that the calculations are correct. If the calculations are not correct, you can raise an EPF internal grievance asking for details.

The passbook can be viewed here. The grievance incase of discrepancy can be raised here. The grievance department are generally very quick and they will assign a field officer to you.

Finally, what can we do if we are contributing above the 2.5L limit? This would actually mean that the interest generated from the contributions above 2.5L would be taxed. So instead of 8.1% tax free returns, we would end up with a return of 5.67%. So personally I dont like the contributions to go above and beyond that 2.5L limit. I would talk to my employer to see if there is a way to reduce my basic pay. Or in case I am contributing to VPF, I would stop contributing to VPF.