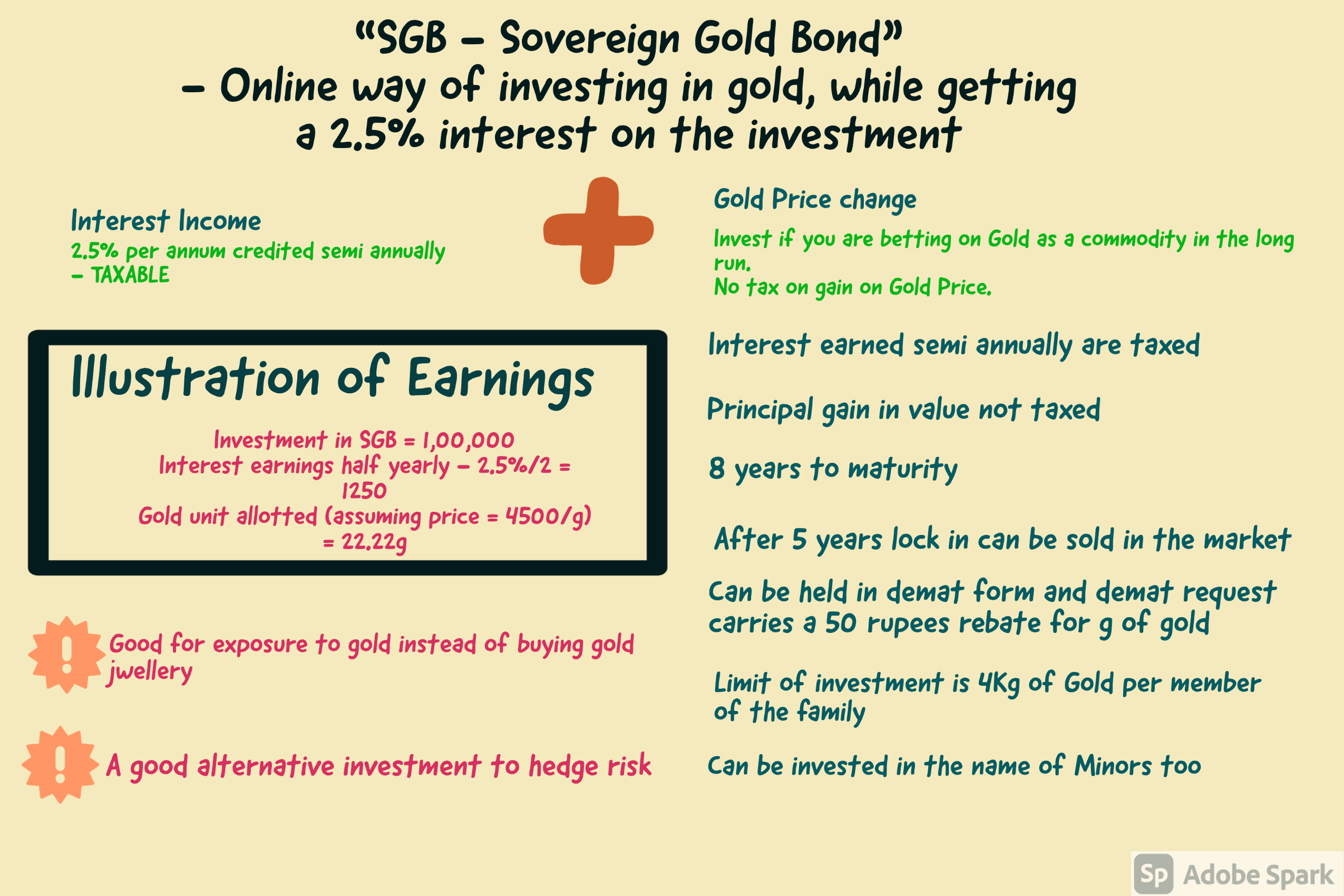

Sovereign Gold Bond (SGB) is a nice way to invest in gold for long term over physical gold. Remember physical gold has wear and tear over a long period of time, but not SGB!

Firstly, it is possible to invest in a minors name. And a family can invest upto 4Kg per member. The lock-in period is 8 years.

Secondly, the major advantage is the safety it provides from wear and tear. Along with the 2.5% taxable interest being provided.

Thirdly, it is important to note that Gold is a beautiful hedge against market investments. Gold and the equity markets have a negative correlation to each other.

Fourthly, it is also possible to exit the fund after 5 years. So this is an ideal instrument for any goal with 5-8 year time frame.

The Sovereign gold bond cannot be invested by NRI’s. And SGB can be invested via RBI Retail Direct portal as well. If you do not know what is RBI Retail direct, please read this blog here.

Finally, the major advantage is that the Principal gain is not taxed when sold. So in almost every way SGB is better than physical gold from an investment purpose.

I agree, I also prefer the Sovereign Gold Bond fund route and not the EGR route. Exactly use it when you need delivery. Thanks!